Understanding CAP Rates

With the strength of the Bozeman rental market, we’ve seen many investors buying up houses, condos, and multi-family homes to use as income producing properties. Individuals looking to purchase income properties may often hear the term Cap Rate. Short for capitalization rate, the Cap Rate is also known as the annual rate of return. The formula for determining the Cap Rate is as follows:

Net Operating Income divided by Purchase Price = Cap Rate

The first step in determining the Cap Rate for a particular property is to establish its yearly Net Operating Income. To calculate Net Operating Income, or NOI, an investor must take the potential Gross Income a property may generate in a year and then deduct taxes, insurance, and any maintenance or management fees. What’s left is the NOI. Once the NOI is calculated, the investor should divide that number by the purchase price of the property. This final number is the Cap Rate.

To illustrate determining a Cap Rate, let us look at this example. An investor purchases a residential property for $285,000 and rents the property for $1,850 a month. The taxes cost approximately $2000 per year, and insurance is another $800. The owner also plans on having a $1500 yearly budget for maintenance. All figures are approximate for this example; actual taxes, insurance, and maintenance costs will vary.

The property brings in $22,200 gross rents per year ($1,850 per month multiplied by 12 months), but after deducting taxes, insurance, and maintenance, the property nets $17,900 per year (this is the NOI). $17,900 divided by $285,000 is .0628, or 6.28 %. This is the investor’s Cap Rate or yearly rate of return on their investment.

Two other factors of Real Estate investment that the Cap Rate does not take into account are property appreciation and the tax benefits of investing in Real Estate. Even though Real Estate Markets will fluctuate up and down, Real Estate has historically proven to appreciate over the long term. Appreciation and tax benefits can increase the actual rate of return for the investment property.

The Cap Rate is useful to compare multiple properties against one another and can even be used to evaluate Real Estate against other investment vehicles such as stocks or bonds.

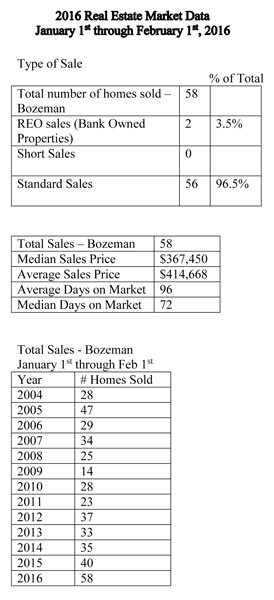

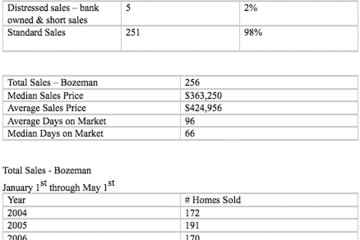

As usual, I have included recent sales data for the first month of 2016. In addition to the 58 homes sold in January, another 142 homes are currently under contract or pending as of the date of writing.

The included data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and Bozeman city limits. The data includes home sales reported through the local Southwest Montana MLS, and does not include private party sales, Condominiums, or Townhouses.