First Steps For Home Buyers

While many potential buyers are lamenting the increase in interest rates over the past year, it has created opportunities for those who can still qualify for financing. During the pandemic years, interest rates were low, but bidding wars made it difficult to compete with cash offers. While some homes are still seeing multiple offers, it is much less common. Buyers looking to finance their purchase generally have more to choose from and a less stressful home buying process than even just a few years ago.

For those folks looking to purchase a home with financing, it’s more important than ever to meet with a lender very early in the process.

One of the most important parts of financing a purchase is understanding how much a buyer can afford. A lender can help by outlining what monthly payments will look like at different price points. Sometimes a buyer might consider buying down the interest rate by paying a little extra at closing to secure a lower interest rate and monthly payment. A lender can help determine if this makes financial sense or not.

They can also help a buyer understand what a reasonable or necessary down payment is. Down payment requirements vary widely depending on the loan program and also what the property will be used for. Some buyers may be surprised to learn that lenders require larger down payments for second homes or income properties. Additionally, the down payment requirements may vary across property types like condos, single family homes, and multi-family properties. Lastly, for some loan programs, if a buyer is not putting 20% down, they may have to pay an extra monthly fee called mortgage insurance, and understanding how that works is very beneficial.

Many first-time buyers are looking to relatives for assistance with their down payment in today’s home buying environment. Lenders generally refer to this as gift funds. It can matter how long the funds for the down payment are in a buyer’s account and where they came from. We’ve heard of buyers undergoing delays when converting crypto currencies into U.S. dollars. Discussing where the down payment funds are coming from and how this will affect the loan is another important basis for meeting with a lender early.

One of the biggest reasons for a buyer to meet with a lender early is to get pre-qualified, so they’re ready to strike when that perfect property hits the market. Many properties come on over the weekend; a buyer may not have time to reach out to a lender to get pre-qualified fast enough if they haven’t done so already.

Tackling the pre-qualification process early is even more important for business owners and high-income earners, as their tax returns are often complicated. It can take extra time for a lender to approve their sources of income.

Lastly, it’s not unheard of for a buyer’s credit score to contain inaccurate information that is leading to a lower credit score. In the event there are mistakes, it can take time to remedy. Getting this checked early will hopefully allow a buyer ample time to get their credit score cleaned up.

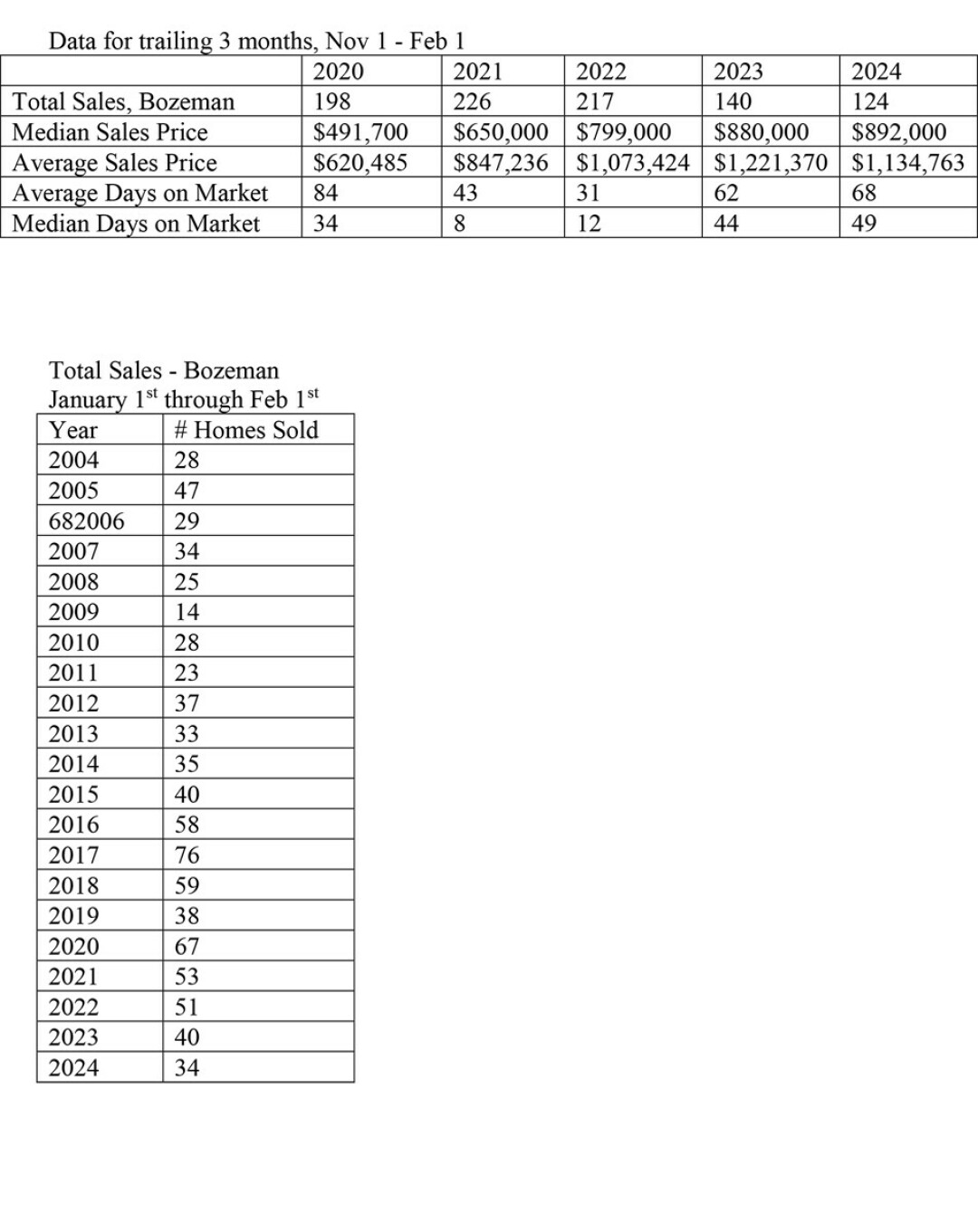

I have included recent sales data for the first month of 2024. In addition to the 34 homes sold in January, another 81 homes are currently under contract or pending as of the date of this writing. This compares to 64 home sales pending at this same time last year.

The included data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and Bozeman city limits. The data includes home sales reported through the local Big Sky Country MLS, and does not include private party sales, condominiums, or townhouses.