Understanding CAP Rates

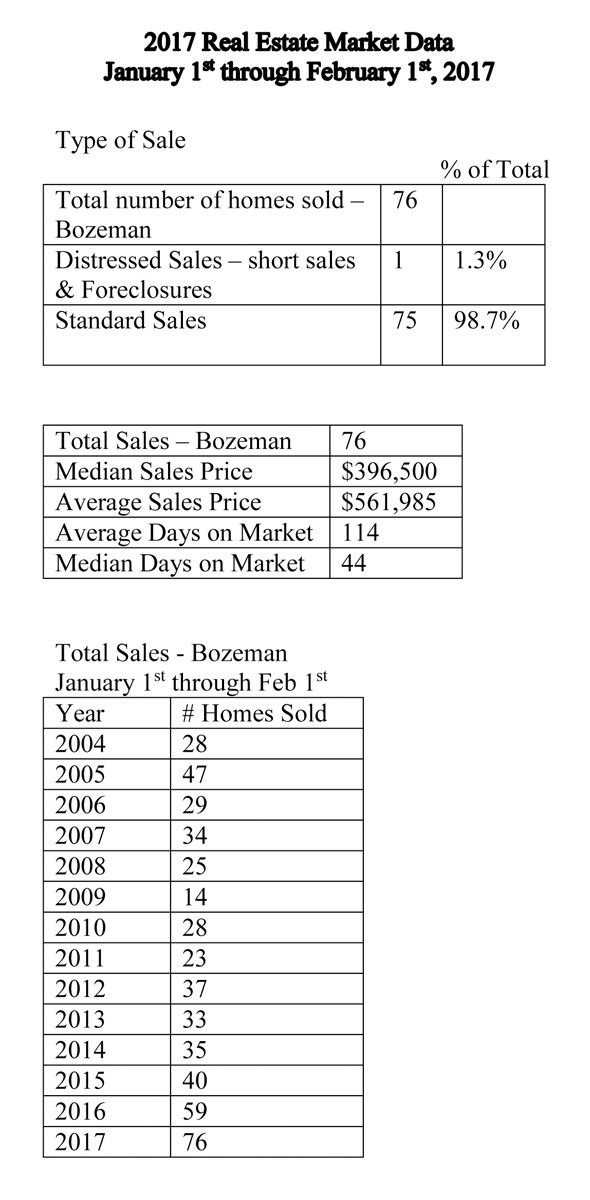

The Bozeman Real Estate market has started off 2017 at a blistering pace. 76 single family homes sold in the first month. This is up over 28% from last January and almost double the number of sales in January of 2015.

The rental market remains very hot and as such many investors are buying up houses, condos, and multi-family homes to use as income producing properties. I thought it wise to revisit a term often used when searching for income properties: Cap Rate. Short for capitalization rate, the Cap Rate is also known as the annual rate of return. The formula for determining the Cap Rate is as follows:

Net Operating Income divided by Purchase Price = Cap Rate

The first step in determining the Cap Rate for a particular property is to establish its yearly Net Operating Income. To calculate Net Operating Income, or NOI, an investor must take the potential Gross Income a property may generate in a year and then deduct taxes, insurance, and any maintenance or management fees. What’s left is the NOI. Once the NOI is calculated, the investor should divide that number by the purchase price of the property. This final number is the Cap Rate.

To illustrate determining a Cap Rate, let us look at this example. An investor purchases a residential property for $300,000 and rents the property for $1,885 a month. The taxes cost approximately $2300 per year, and insurance is another $800. The owner also plans on having a $1500 yearly budget for maintenance. All figures are approximate for this example; actual taxes, insurance, and maintenance costs will vary.

The property brings in $22,620 gross rents per year ($1,885 per month multiplied by 12 months), but after deducting taxes, insurance, and maintenance, the property nets $18,020 per year (this is the NOI). $18,020 divided by $300,000 is .06, or 6%. This is the investor’s Cap Rate or yearly rate of return on their investment.

Investors can use the Cap Rate to compare multiple properties against one another, or even to compare a Real Estate investment against another vehicle, such as stocks or bonds. However, two factors it does not take into account are the tax benefits of owning Real Estate and the potential for appreciation, which can both add to the actual rate of return. The Cap Rate can also be run backwards to determine what income a property would need to generate in order to hit a desired return.

I have included recent sales data for the first month of 2017. In addition to the 76 homes sold in January, another 135 homes are currently under contract or pending as of the date of writing.

The included data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and Bozeman city limits. The data includes home sales reported through the local Southwest Montana MLS, and does not include private party sales, Condominiums, or Townhouses.