Considering A Purchase? Five Reasons to Meet with a Lender Early

Trying to buy a home in any market is challenging right now, and Bozeman is one of the hottest and most competitive markets for home buyers. For those folks even considering financing the purchase of a home, it’s more important than ever to meet with a lender very early in the process.

One of the most important parts of financing a purchase is understanding how much a buyer can afford. A lender can help by outlining what different monthly payments will look like at different price points. Sometimes a buyer might consider buying down the interest rate by paying a little extra at closing to secure a lower interest rate and monthly payment. A lender can help determine if this makes financial sense or not.

A lender can also help a buyer understand what a reasonable or necessary down payment is. Down payment requirements vary widely, depending on the loan program and what the property will be used for. Some buyers may be surprised to learn that lenders require larger down payments for second homes or income properties. Additionally, the down payment requirements may vary across property types like condos, single-family homes, and multi-family dwellings. Lastly, for some loan programs, if a buyer is not putting 20% down, they may have to pay an extra monthly amount for mortgage insurance, and understanding how that works is very beneficial.

Many first-time buyers look to relatives for assistance with their down payment. Lenders generally refer to this as “gift funds.” It can matter how long the funds are in a buyer’s account, and where they came from. We’ve heard of buyers experiencing delays when converting cryptocurrencies into U.S. dollars. Discussing where the down payment funds are coming from and how this will affect the loan is another important basis for meeting with a lender early.

One of the biggest reasons to meet with a lender early is to get pre-qualified, so you’re ready to strike when that perfect property hits the market. Properties in today’s market frequently receive offers within hours of hitting the market. Hours, not days. Many properties come on over the weekend, and a buyer may not have time to reach out to their lender to get pre-qualified fast enough if they haven’t done so already. Pre-qualifying early in the process is vital, especially when so many properties are seeing multiple offers. Tackling the pre-qualification process can be more important for business owners and high-income earners, as their tax returns are often complicated, and it can take extra time for a lender to approve their sources of income.

Lastly, it’s not unheard of for a buyer’s credit score to contain inaccurate information, leading to a lower score. In the event there are mistakes, it can take time to remedy. Getting this checked early will hopefully allow a buyer ample time to get their credit score cleaned up if need be.

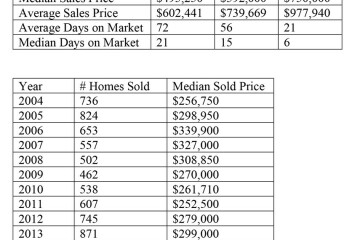

I have included recent sales data for the first month of 2022. In addition to the 51 homes sold in January, another 83 homes are currently under contract or pending as of the date of writing. This data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and within Bozeman city limits. The data includes home sales reported through the local Big Sky Country MLS; it does not include private party sales, condominiums, or townhouses.