New Year New Opportunities

Happy New Year! I hope that 2022 was a phenomenal year for you and that 2023 will bring wonderful experiences and great joy. As we reflect on the last 12 months’ accomplishments and look forward to the year ahead, it is a great time to consider what opportunities the future may bring.

As I write this, mortgage interest rates have increased from their record lows that had come to feel normal over the past few years. Although the increased rates are still historically low by some standards, they have affected both buyers’ ability to buy and, consequently, some sellers’ ability to sell. The Real Estate market is currently evolving. As it evolves, there could be many new opportunities.

The year 2023 may see a return of creative deal structuring and seller financing. When interest rates were low and money was easy to get, seller financing became very rare. That is starting to change, as we have already seen some sellers starting to advertise seller financing options and loan assumptions. This presents opportunities for both buyers and sellers. Both parties get the opportunity to negotiate the terms of the financing. Sellers get an opportunity to make some additional interest payments and may be able to utilize tax deferment, or take advantage of other tax opportunities. Buyers could get the opportunity to get into a property at a more favorable rate, or under terms more preferable than those they could realize with traditional financing.

For buyers, there are already a lot of opportunities that didn’t exist last year. Many buyers that either offered on or purchased real estate over the past 24 months had to plan on making up the difference if the property didn’t appraise for purchase price, or made offers that skipped inspections. For buyers that lament the loss of the low interest rates, it’s well worth exploring some of the creative opportunities to buy down interest rates. There are opportunities to temporarily or permanently buy down rates to help with monthly affordability. Sellers are becoming more willing to help pay for these rate buy-downs, giving buyers a great opportunity to skip the bidding wars and still get an attractive rate.

More opportunities exist for those homeowners looking to upsize or downsize. Over the past few years, as new listings saw multiple offers and bidding wars were normal, homeowners who needed to sell another property in order to buy were often unable to compete with buyers who had cash in hand. As the average days on market inches up, more sellers may consider an offer that is contingent upon the sale of another property. Those looking to make a move across town can do so with the comfort of knowing that whatever happens to real estate pricing will most likely affect both properties in a similar fashion, so there’s no need to worry about whether prices will go up or down after they sell and buy.

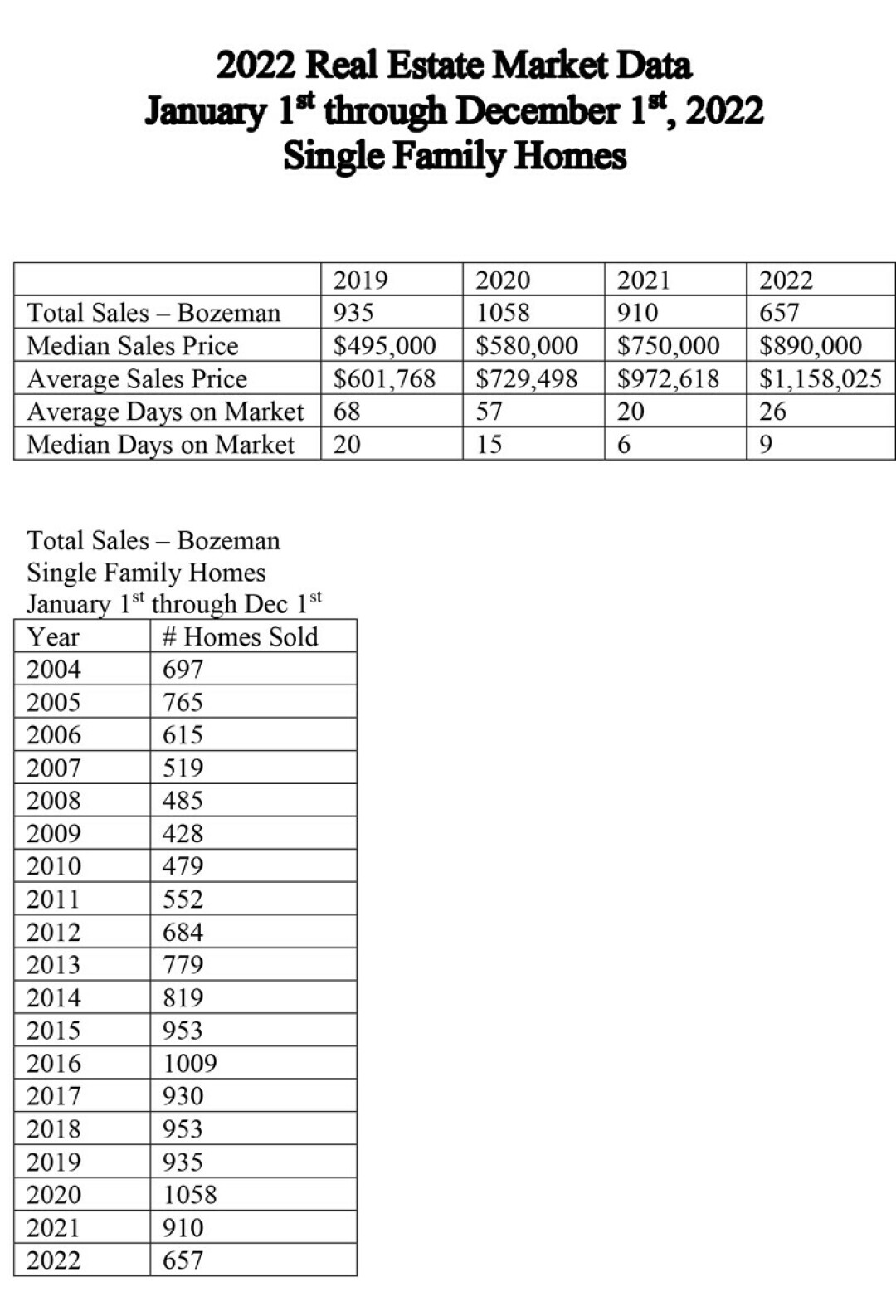

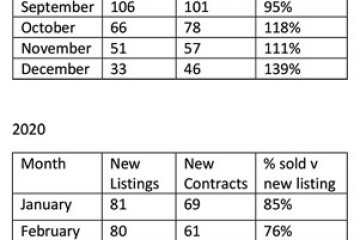

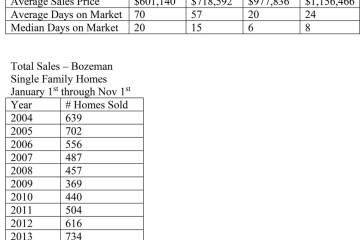

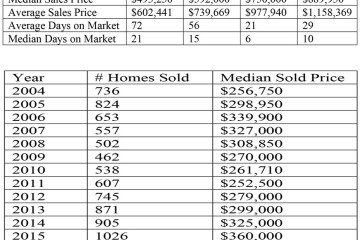

As usual, I have included data for the number of homes sold in Bozeman during the first 11 months of 2022. In addition to the 657 homes sold during this time period, another 64 home sales are currently pending, or are under contract as of the date of this writing.

The included data reflects sales of homes in the greater Bozeman area, including Four Corners, Gallatin Gateway, Bridger Canyon, and Bozeman city limits. The data includes home sales reported through the local Big Sky Country MLS, and does not include private party sales, condominiums, or townhouses.